| InsuranceRanked Score | 4.86 |

|---|---|

| Year Founded | 2015 |

| AM Best Rating |

| InsuranceRanked Score | 4.86 |

|---|---|

| Year Founded | 2015 |

| AM Best Rating |

•

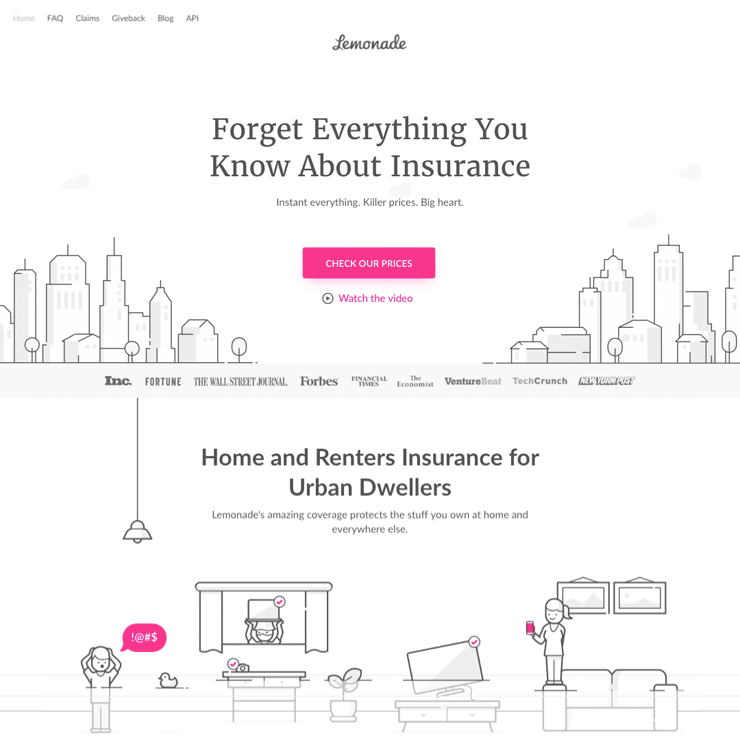

Lemonade is a nationwide insurance provider best known for its streamlined application and submission process, AI-assisted underwriting process, and commitment to distributing a portion of profits to charity. Lemonade has recently introduced pet insurance to its list of products, allowing pet parents to buy policies that reimburse up to 90% of the cost of emergency vet care. While Lemonade’s policies may not be as inclusive as some competitors, its low prices and quick repayments can make it a great choice for both cat and dog owners.

Lemonade offers one accident and illness plan that includes coverage for most veterinary care services your pet might need after a sudden injury or if they develop an illness over time. Some examples of items included under Lemonade’s accident and illness coverage include diagnostic tests, surgeries, chemotherapy and other cancer treatments, and ambulatory care.

Lemonade’s policies include some notable exclusions, ranging from veterinary exam fees to physical therapy. While you can add coverage for these items as optional add-ons, they are commonly included as standard coverages with other accident and illness plans. Despite these exclusions, Lemonade’s policies are affordable, offering up to $100,000 in annual coverage with reimbursement rates ranging between 70% and 90%. Plans also start at just $10 per month, making them accessible to most pet owners.

Best known for its renter’s insurance and life insurance policies, Lemonade is an insurtech company that combines automated underwriting with a streamlined application to save you both time and money. Lemonade extends this model to its pet insurance policies, which feature the following characteristics:

In addition to accident and illness plans, Lemonade also offers multiple tiers of wellness coverage. The price of wellness add-ons (as well as standard premiums) is based on a range of individual factors, including your pet’s age, gender, location, and health history.

Lemonade offers one accident and illness plan, which has its benefits and drawbacks.

Lemonade’s pet insurance comes with the benefit of being easily accessible and affordable. While policies are not available in every state and aren’t the most inclusive plans that you’ll find online, coverage for dogs and cats starts at $10 per month. This can make Lemonade best for:

Lemonade’s simple application allows you to adjust reimbursement rates, deductible options, and annual coverage limits to see how each affects your price. If you’ve been holding off on shopping for pet insurance because you think you might not be able to afford coverage, Lemonade’s intuitive application can be an excellent place to start.

Lemonade’s online pet insurance application is simple—most shoppers will be able to sign onto coverage in just a few minutes. Follow these steps to get coverage:

Unlike Lemonade, Embrace offers the option to add unlimited annual coverage to any dog or cat insurance. Embrace also offers a single accident and illness plan, with coverage extending to exam fees and dental injuries. Embrace’s policies also include access to a 24/7 pet helpline, which may help you save on unnecessary vet visits.

While Embrace’s policies are more inclusive, they’re also more expensive. Deductibles range from $100 to $1,000 with Embrace, meaning you might end up paying twice as much each year before you can use your coverage. A four-year-old Golden Retriever living in Philadelphia, PA can expect to pay about $24 per month for a $20,000 policy with a $500 deductible and 80% reimbursement rate with Lemonade. The same pet would pay about $55 a month for similar coverage.

Lemonade pet insurance is legitimate, providing you with the peace of mind that comes with both financial stability and an established company history. Lemonade has received a Financial Stability Rating of A-Exceptional from Demotech Inc., and the company has been in business for seven years. While Lemonade is not currently accredited or rated by the BBB, it is a publicly-traded company on the New York Stock Exchange, as well as a public benefit corporation and a certified B-Corp.

Lemonade pet insurance begins by collecting a little information on yourself and your pet to determine your premiums. You can enroll in coverage online or directly through the app. When you need to use your coverage, simply snap a picture of your vet bills, and Lemonade will handle the reimbursement process.

Lemonade Insurance Agency, LLC underwrites Lemonade pet insurance. Lemonade is able to underwrite its own policies, and its financial strength indicates that there is not a major risk of Lemonade being unable to meet its obligation to policyholders in the near future.

Lemonade pet insurance is affordable partially because the company employs a completely online application process. While operating as an online insurer does mean that Lemonade can’t provide a sit-down experience with a representative, it does allow the company to pass along savings to customers. Lemonade employs an automated underwriting process as an additional cost-cutting measure.